Properly of us, as anticipated, bidding wars are again with a vengeance, no less than right here in San Francisco.

If I had been an actual property agent, I might by no means encourage my purchasers to interact in a bidding conflict. Profitable such a conflict usually results in what’s referred to as the “winner’s curse.” This time period signifies paying a worth that exceeds what anybody else within the bidding conflict was keen to pay, placing your funds at larger danger if the true property market takes a downturn.

Personally, I keep away from bidding wars as a result of I do know my feelings can cloud my judgment. It is akin to my method to poker—I chorus from heavy ingesting to maintain a transparent head for rational decision-making. And for these searching for love, take off these beer goggles!

This publish delves into the the explanation why folks enter property bidding wars. I purpose to grasp why potential property homeowners disregard my recommendation of looking for houses in the course of the sluggish winter months. It baffles me why extra potential homeowners would not choose to underbid on a poorly marketed, mispriced, or stagnant itemizing fairly than one which’s offered completely.

I search to know as a result of I’ll have a blind spot that requires fixing. Let me share some bidding conflict examples adopted by suggestions from an actual property agent and three homebuyers on why they engaged in a bidding conflict.

Why I At the moment Care So A lot About The Housing Market

I have been carefully following the housing market since buying my new house on the west aspect of San Francisco within the fall of 2023. For months, I skilled each a liquidity crunch in addition to doubt on whether or not I had made the proper choice to slash my passive revenue for a nicer home.

Because the inventory market marched larger after I offered shares (and bonds) to purchase the home, I felt conflicted. On the one hand, I used to be lacking out on inventory market beneficial properties. Alternatively, my household was having fun with a nicer place to reside. The house buy may grow to be the largest or worst monetary mistake of my life.

Greater than seven months later, I am relieved to say that purchasing this home has turned out positive thus far. The house withstood heavy rainstorms in the course of the winter with out leaks, which is my most regarding home upkeep subject. In the meantime, housing costs have rebounded in spring 2024 due to pent-up demand, an increase in tech shares, and a continued dearth of stock.

Listed below are some examples of houses that offered means above asking. If one among these houses occurs to be yours and also you need it taken down, be at liberty to go away a remark or shoot me an e-mail.

Examples Of Property Bidding Wars In San Francisco

1615 Funston Avenue (Internal Sundown/Golden Gate Heights border)) – 2 beds, 1.5 baths, 1,230 sqft, asking $1,495,000, offered for $1,675,000, or $180,000 over asking (12%). Though a small home, it’s properly transformed inside and outside. Paying underneath $2 million for a transformed single-family house in San Francisco is what a whole lot of households need.

220 Magellan Avenue (Forest Hill) – 3 mattress, 2.5 bathtub, 2,455 sqft, asking $2,795,000, offered for $3,125,000, or $330,000 over asking (11.8%). Good-looking house on a tree-lined block in one of the best neighborhood on the west aspect of San Francisco. The worth level between $2 – $3.5 million is frequent for twin revenue, mid-career households with youngsters.

68 Madrone Avenue (West Portal) – 3 mattress, 3.5 bathtub, 2,836 sqft, asking $2,495,000, offered for $3,125,000, or $630,000 over asking (25.25%). Though it offered for 25.25% over asking, the value appears cheap for its measurement and placement.

80 San Pablo Avenue (St. Francis Wooden ) – 3 beds, 2.5 baths, 2,190 sqft, asking $2,295,000, offered for $2,500,000, or $205,000 over asking (9%). A quaint home at an affordable worth on a comparatively quiet road. St. Francis Wooden is one among my favourite neighborhoods with solely single-family homes. The one damaging is that the neighborhood is bordered by some very busy streets in addition to a heavy-traffic intersecting road.

A number of Actually Large Overbids

120 Lenox Means (West Portal)- 4 beds, 2.5 baths, 2,221 sqft, asking $1.795 million, offered for $2.56 million, or $765,000 over asking (42.6%). The home obtained 15 gives and is throughout from a playground and faculty. Relying on the person, this could be a good or dangerous factor. The home is barely a block away from the MUNI station, and two blocks away from retailers and eating places.

3782 twenty first Road (Dolores Heights) – 2 beds, 2.5 baths, 1,844 sqft, asking $2,395,000, offered for $3,225,000, or $830,000 over asking (34.6%). This was actually an incredible sale given how small the home is, in addition to the lot measurement of just one,410 sqft. Customary lot sizes in San Francisco are 2,500 sqft. It is a charming home for positive. However wow.

150 Santa Paula Avenue (St. Francis Wooden) – 5 beds, 3 baths, 3,585 sqft, asking $4,795,000, offered for $5,705,000, or $910,000 over asking (19%). The vendor obtained a preemptive provide just one week after itemizing, so there was truly no bidding conflict.

The home sits on a big 8,659 sqft lot, which is extraordinarily uncommon in San Francisco. For a household with youngsters and canines, this enclosed yard is particular.

The gross sales worth of $5,705,000 blows previous Redfin’s estimate, which is in keeping with most of those latest gross sales.

240 Santa Paula Avenue (St. Francis Wooden) – 3 beds, 2.5 baths, 2,298 sqft, asking $2,695,000, offered for $3,325,000, or $630,000 over asking (23.4%). A singular home that jogs my memory of houses in Hansel and Gretel. I am unsure why somebody needed to pay a lot over asking given its common measurement. It is also bordering the playground/park, which may be each good and dangerous, relying on who you ask.

Some Spectacular Gross sales Beneath Asking

Should you go up the value curve, you may typically get higher offers. Bidding wars are extra uncommon at larger worth factors just because fewer folks can afford these houses.

565 Ortega Road (Golden Gate Heights) – 5 beds, 3.5 baths, wonderful transform asking $5,950,000, offered for $5,550,000. This was one of many coolest homes I’ve ever seen as a result of design. It felt like a prized murals with a separate unit and panoramic ocean views. I really like this home.

The itemizing agent did not record the estimated sqft seemingly as a result of it might put the home at an all-time excessive worth/sqft primarily based on the asking worth. If you should buy a single-family house with a water view, I believe you are going to outperform the market for a very long time. Golden Gate Heights is one among my favourite areas to purchase single-family houses in San Francisco.

This home was a intestine transform that took what looks as if over 5 years. My fundamental concern is fixing customized objects and sourcing customized supplies when one thing inevitability breaks.

The earlier proprietor bought the home for $2,650,00 in July 2016. Discover how the gross sales worth of $5,550,000 fully obliterates the Redfin estimate as a result of transform. Now Redfin’s algorithm must recalculate different houses within the space.

3846 twenty fifth St. (Noe Valley) – 4 beds, 3.5 baths, newly transformed asking $6,495,000, offered for $6,375,000. Spectacular excessive finish transform and landscaping. These kind of transformed houses used to promote for nearer to $4.5-$5 million.

3898 Washington Road (Presidio Heights) – 7 beds, 6 baths, 8,765 sqft, asking $14,950,000, offered for $14,700,000. Good-looking house on a nook lot that will get a whole lot of mild. Personally, I might fairly not reside on the nook as a result of extra visitors publicity. Presidio Heights is likely one of the most costly neighborhoods in all of San Francisco.

As soon as extra, you may observe how the gross sales worth considerably exceeds the Redfin estimate. Redfin would require a while to regulate its pricing algorithm to precisely mirror the rising costs within the neighborhood.

The inaccuracy in housing estimates offered by Zillow and Redfin presents a possibility for each sellers and consumers. If a purchaser can discern that on-line housing valuation estimates are likely to lag behind in a bullish market, they could endeavor to persuade a much less astute vendor to conform to a decrease market worth.

Suggestions From Homebuyers And Actual Property Brokers Who Obtained Into Property Bidding Wars

To grasp why folks get into property bidding wars, I made a decision to survey my Twitter followers and e-newsletter readers. Right here is a few of their suggestions:

Nameless suggestions on getting right into a bidding conflict in 2022:

Two years in the past, we purchased a small apartment in a school city for my daughter to reside in whereas she attends college. I grew up close to that city, so I’m aware of and I really like the world.

Sure, I perceived it as a bit dangerous to compete in a bidding conflict for the apartment. Nonetheless, we heard horror tales about so many school college students in that space who struggled to find appropriate housing. We didn’t need to search and compete for a spot each college yr.

Additionally, my daughter could be very personal and choosy and hasn’t carried out nicely with roommates. I intend to maintain the property for the long run, so I wasn’t as frightened concerning the precise buy worth. We would have liked the property, since I might have needed to pay hire at one other place if I didn’t purchase it.

There had been a stagnant itemizing out there that winter. Nonetheless, it wanted extra work carried out to it and had unique home windows and home equipment. Additionally, the stagnant itemizing didn’t have a southern orientation and peaceable view.

Within the latest previous, we had bought a home with a northern publicity in our metropolis the place we reside full time. We have been dissatisfied with how chilly and darkish our home is throughout winter months with out operating the heater lots. Operating the heater doesn’t present the nice heat of daylight.

I had determined that I might not buy a spot for household use with no southern publicity. I assume I used to be keen to pay 8% extra to have southern daylight and never be wanting right into a neighbor’s place.

Previously two years, I’ve by no means regretted coming into into and prevailing in a bidding conflict for my daughter’s peaceable, sunny apartment. Additionally, I knew that if circumstances change, I can simply hire the apartment out to school college students for a profitable quantity.

Retaining property for the long run requires a giant dedication of time and ongoing expenditures. If in case you have an emotional connection to the property, it helps you climate the draw back of long run property possession like a nightmare tenant state of affairs or a significant plumbing subject.

Thanks on your terrific articles!

Jaime Meraz, Realtor primarily based in Phoenix, Arizona

Marcus, 40, purchaser in San Francisco, California

Earlier than shopping for our home, my spouse and I resided in a one-bedroom, one-bathroom residence. However with a child on the best way, we would have liked extra space. Having labored as a software program engineer at Tesla for 5 years, I used to be lucky to stroll away with roughly $2 million in fairness after taxes.

Contemplating my present wage of $200,000, together with inventory choices, and my spouse’s wage of $150,000, we will comfortably put down $500,000 for a $2.5 million home. This implies we would be taking a look at a month-to-month mortgage cost of $13,700 at a 7.3% mortgage fee with over $1.5 million in money and liquid investments left over.

We anticipate a window to refinance to a decrease mortgage fee inside the subsequent 5 years. By then, we anticipate our revenue to have elevated as nicely.

Janet, 38, purchaser in Northern Virginia suburb

Through the winter, the housing stock wasn’t notably interesting, and we had been decided to solely make a purchase order if we stumbled upon one thing actually distinctive. Then, in March, our dream house appeared—a spacious property with a surprising view. What made it much more interesting was that the sellers had lately renovated the home, sparing us from potential renovation complications we would heard about.

With our youngsters aged 8 and 10, and plans to reside within the space for no less than a decade, we felt assured in our choice. The faculties are glorious, and there are respected public universities close by. Even when we might have barely overspent, our long-term dedication to the home reassured us. Who is aware of, we would even make it our eternally house.

With a mixed revenue of about $280,000, we bought a $1.2 million house that was listed for $1.1 million in Fairfax County. Admittedly, we deviated out of your 30/30/3 house shopping for rule, however we managed to place down $350,000. Our mortgage is a 6.5%, 30-year fastened fee, amounting to $6,000 per thirty days. Nonetheless, with a gross month-to-month revenue of $23,333, we really feel it’s inexpensive.

Up to now we love the home and don’t have any regrets.

Ideas On the Property Bidding Warfare Suggestions

There are two key takeaways from the owners who shared why they engaged in a property bidding conflict.

1) They will comfortably afford the costs they pay.

There appears to be a false impression that solely determined or financially inexperienced consumers take part in bidding wars, stretching themselves skinny. Nonetheless, it seems that well-educated consumers with sturdy monetary profiles are those keen to overbid on houses.

Reflecting by myself expertise, I notice I lack the boldness to overbid as a result of a previous setback in 2007 after I ended up paying an excessive amount of for a apartment in Palisades, Lake Tahoe. That have left an enduring influence, shaping my future decision-making.

2) All of them have youngsters.

Each purchaser talked about having youngsters, starting from these but to be born to school college students. The need to offer a cushty house for one’s youngsters is a powerful motivator. Certainly, I consider one of the best time to personal the nicest home you may afford is when you could have essentially the most relations underneath one roof.

Involved concerning the future price of housing when my youngsters are prepared to purchase houses in 20-25 years, I’ve chosen to hedge my bets by investing in no less than one rental property per member of the family. Whereas my major actual property objective is to generate semi-passive revenue for retirement, I additionally purpose to offer my youngsters with inexpensive housing choices sooner or later.

3) All of them plan to reside of their new homes for a very long time.

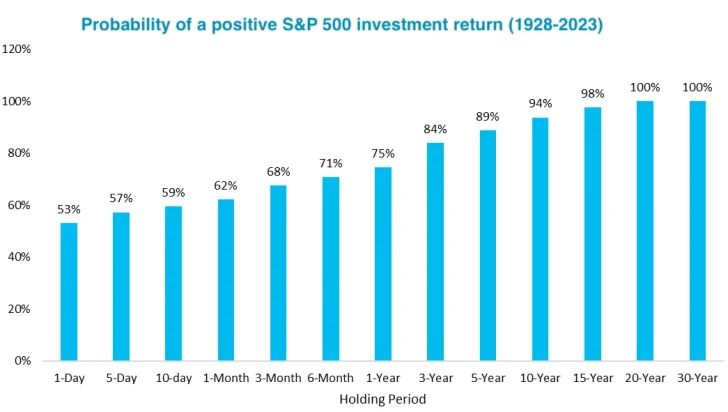

The longer a property bidding conflict winner lives of their house, the larger their probabilities of constructing fairness. It is the identical thought with proudly owning shares.

At the moment, the median homeownership period is about 12 years. If bidding conflict winners can maintain for no less than the median period, they’ll seemingly nonetheless make a revenue once they promote.

Please Nonetheless Be Cautious About Overbidding On a Property

After going via this train, I nonetheless maintain reservations about partaking in property bidding wars. At coronary heart, I am a cut price hunter, at all times looking out for worth as a result of mispricing, dangerous timing, or ineffective advertising and marketing. As a result of actual property transactions closely depend on folks, I consider savvy consumers can exploit inefficiencies to safe a greater deal.

I’ve documented numerous methods I’ve employed to barter decrease buy costs, corresponding to delaying escrow, writing heartfelt actual property love letters, making gives with no financing contingencies, and pursuing twin company routes. All these techniques have confirmed efficient in my 21+ years of actual property investing. Therefore, I discover it troublesome to deviate from my established method.

Nonetheless, for many who have emerged victorious in property bidding wars, there’s reassurance within the relative effectivity of the true property market.

Merely underbidding on a property does not routinely translate to a greater deal; maybe the property was initially priced too excessive. Conversely, paying 20% over asking does not essentially equate to overpayment; it might point out the property was initially underpriced.

There’s At all times One other Good Dwelling Ready To Be Bought

In the long term, the market will decide the truthful worth of a house. My concern is that heightened feelings usually cloud the judgment of potential homebuyers. Many envision an idyllic life of their future house, main them to consider it is value paying extra for perfection.

The truth is, in case you miss out on one house, there’ll at all times be one other equally appropriate choice for your loved ones. It is important to acknowledge this and train endurance.

Set up a definitive most worth you are keen and capable of pay, and stick with it, it doesn’t matter what. Following this recommendation will reduce the chance of purchaser’s regret and safeguard your monetary well-being within the course of.

Better of luck on the market!

Reader questions

Why do you assume consumers are keen to interact in property bidding wars, regardless of the chance of paying an excessive amount of? Should you’ve ever received a property bidding conflict, please share your expertise and reasoning to assist us perceive why. Why not simply wait till the 4th quarter to purchase given there’s much less competitors and extra wiggle room for worth changes?

Make investments In Actual Property Extra Strategically

As a substitute of getting right into a bidding conflict, think about investing in passive actual property investments throughout the nation for diversification, passive revenue, and probably higher returns.

Contemplate Fundrise, a number one personal actual property funding agency with over $3.3 billion in property underneath administration. Fundrise primarily focuses on residential and industrial actual property within the Sunbelt area, the place valuations are typically decrease and yields are typically larger.

Personally, I’ve allotted $954,000 to personal actual property funds, primarily concentrating on properties within the heartland. With distant work turning into extra frequent, it is cheap to anticipate that Individuals will more and more gravitate towards lower-cost areas of the nation.

Fundrise is a sponsor of Monetary Samurai and Monetary Samurai is an investor in Fundrise.