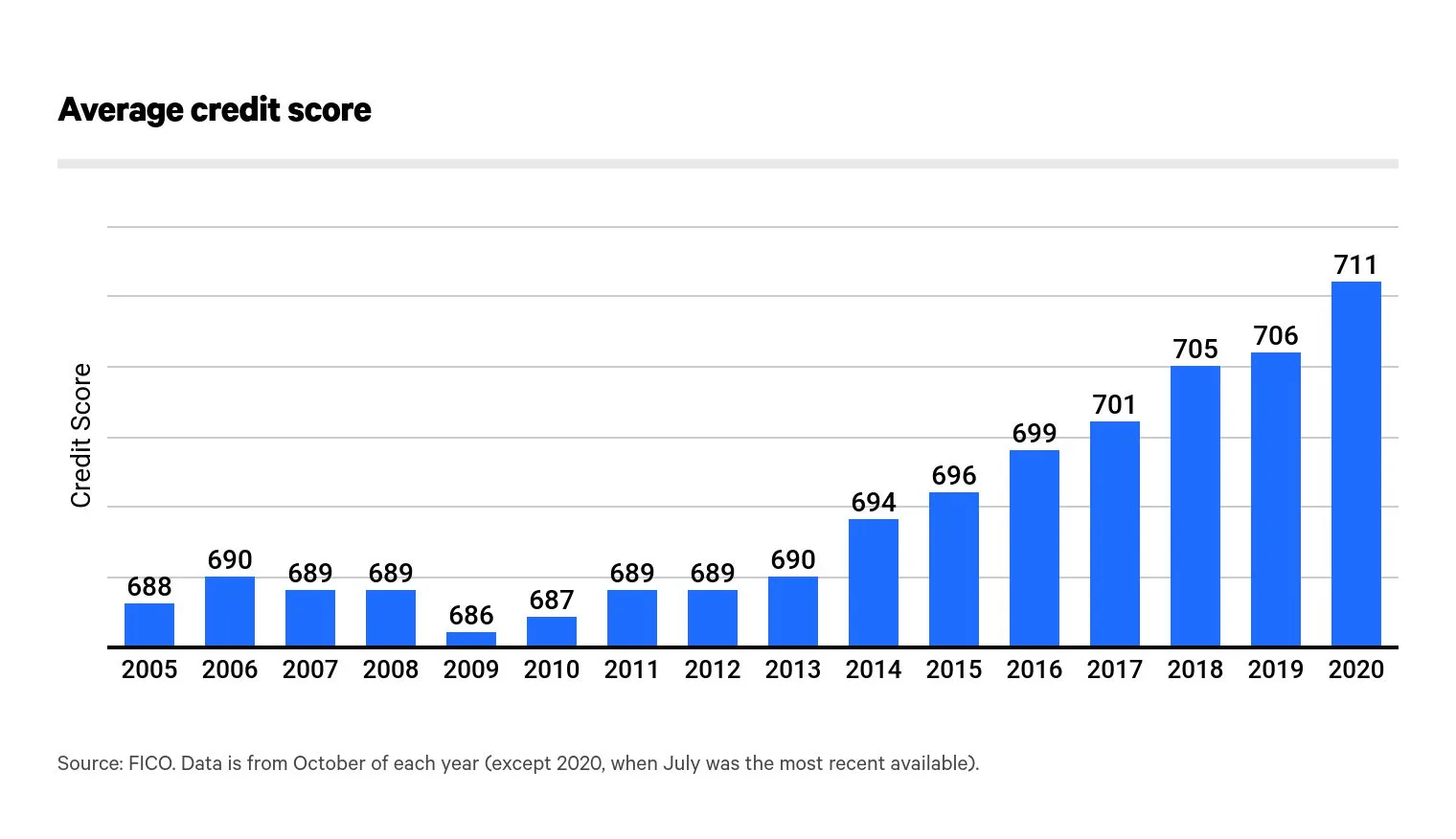

The upper your credit score rating, often the decrease your mortgage charge. Each time I went to use for a brand new mortgage or refinance an present mortgage, my mortgage lender would first ask for my credit score rating. If I stated something decrease than a 720, they might politely inform me to look elsewhere.

Earlier than the 2008 international monetary disaster, a credit score rating of 720 and above meant debtors might get the bottom mortgage charge with the bottom charges. Nevertheless, after about 2012, to get the bottom mortgage charge with the bottom charges typically required not less than an 800 credit score rating out of 850.

In consequence, I made a decision to pursue methods to get an 800+ credit score rating to be able to get monetary savings. On September 6, 2013, I lastly broke 800 and have stayed above 800 ever since.

An 800+ credit score rating enabled me to buy a brand new property at a aggressive charge in 2014. Then in 2018, I refinance the property to a fair decrease charge. Extra not too long ago, I used to be in a position to purchase a endlessly house in mid-2020 with a 7/1 ARM at solely 2.125%. Being a accountable borrower has paid off.

However what if debtors with larger credit score scores needed to pay larger charges? On the margin, it might disincentivize homebuyers from being accountable debtors. In consequence, lower-credit high quality homebuyers would enter the market, thereby growing the danger of one other housing disaster.

This does not sound nice, however perhaps there’s a silver lining to this perverse incentive construction.

Larger Credit score Rating Now Means Larger Mortgage Charges

The Federal Housing Finance Company (FHFA) has recalibrated the price construction for loan-level worth adjustment (LLPA) by decreasing charges for some debtors and climbing these for others.

Earlier than Might 1, 2023, for instance, in case you had a credit score rating of 740 or larger, on a $500,000 mortgage, you’ll pay a 0.25% price, or $1,250. After Might 1, you’ll pay as a lot as 0.375% – or $1,875 – on that very same mortgage.

Paying as much as $625 extra in charges appears important. It’s a 50% improve from what you’ll have paid earlier than the FHFA modified the principles.

In one other instance I noticed, homebuyers with credit score scores of 740 to 759 – thought of “excellent” – and placing 20% down will face a brand new LLPA of 1%, in contrast with 0.5% beforehand. For the acquisition of a $500,000 house, meaning the price doubles to $5,000 from $2,500.

Would you be OK paying $2,500 extra? I would not. Beneath is an instance of varied mortgage refinance financial institution charges.

If No Larger Charge, Then A Larger Mortgage Price

If the homebuyer is not explicitly paying the next mortgage price, then the price will get rolled up into the next mortgage charge. The lender has to earn a living someplace. Therefore, do not be fooled by a “no-cost refinance.“

The beneath graphical instance reveals somebody with a 740 credit score rating paying a 0.25% larger mortgage charge than somebody with solely a 660 credit score rating. A 0.25% mortgage charge distinction is critical.

In my expertise of aggressively procuring round for mortgages, 0.25% is the most important low cost a competing lender would ever give me. And typically, I might solely get a 0.25% decrease charge by transferring property and relationship pricing.

Decrease Credit score Rating Now Means Decrease Mortgage Charges Or Charges

If all people is getting squeezed with larger charges and better mortgage charges, then getting squeezed is less complicated to take. Nevertheless, the Federal Housing Finance Company has additionally determined to decrease the charges for individuals with decrease credit score scores.

For instance, beginning in Might 2023 a homebuyer with a credit score rating of between 640 to 659 and who has a down cost of solely 5% will incur a loan-level worth adjustment price of 1.5%, down from 2.75%.

Which means somebody buying a $500,000 house would now “solely” pay an LLPA price of $7,500, down from $13,750 beforehand. The unique LLPA price of two.75% sounds egregious. So this can be a important profit for these decrease credit score rating potential homebuyers.

A 1.5% LLPA price a decrease credit score rating borrower pays remains to be 0.5% larger than the best LLPA price a excessive credit score rating borrower pays.

Nevertheless, the misplaced 1.25% in LLPA charges is now being made up by homebuyers with larger credit score scores. Folks with decrease credit score scores are both being rewarded or being given a break. Your view is determined by your philosophy.

Mortgage Originations By Credit score Rating

Absolutely the proportion improve in charges larger credit score rating debtors will now pay is not as nice as absolutely the proportion lower in charges decrease credit score rating debtors can pay. Nevertheless, the distinction must be made up by quantity.

Folks with larger credit score scores make up nearly all of debtors.

Beginning round 2010, nearly all of mortgage originations got here from homebuyers with 760+ credit score scores. Then beginning round 1Q2020, these with 760+ credit score scores began to essentially dominate mortgage originations (mild blue bar).

The primary purpose for these adjustments is tighter lending requirements after the 2008 international monetary disaster and the pandemic.

Given house costs have additionally boomed since 2010, wealth has principally accrued to these with the best credit score scores. In the meantime, these with credit score scores beneath 660 have largely been shut out of the housing market since 2009 (yellow and darkish blue).

The federal authorities checked out this information and determined to vary the price construction within the title of equitable entry to house possession. The wealth hole between householders and non-homeowners has grown too giant. All of the price adjustments is doing is creating extra parity between what excessive and decrease credit score rating debtors pay.

You possibly can learn the Federal Housing Finance Company’s clarification assertion defending its new mortgage pricing.

Total Implications Of Charge Modifications Based mostly On Credit score Rating

As soon as excessive credit score rating homebuyers know they have to pay this larger price, they could negotiate tougher with their lenders to get a larger low cost. Purchasing round for a mortgage is all the time a good suggestion. However this additionally means there can be additional pressure on the lending trade, which has already seen quantity dry up resulting from larger mortgage charges.

In the event you work within the mortgage enterprise, you most likely really feel such as you’re getting kicked after you have already fallen down. Rationally, lenders will begin pursuing householders with “honest” credit score scores of 660 or much less by pitching decrease charges.

As well as, excessive credit score rating homebuyers might negotiate extra aggressively with house sellers to get worth concessions. Extra negotiating often means longer closing occasions. Longer closing occasions typically improve the probabilities of a deal falling via.

Larger charges for larger credit score rating debtors imply decrease lending and residential sale quantity on the margin. In consequence, commissions earned in the actual property trade will even decline. Due to this fact, I ought to add unknown new authorities rules as a danger to my constructive actual property name for 2023.

Then once more, if the decrease mortgage charges and charges deliver in additional homebuyers, there could possibly be upward strain on house costs. This, in flip, would enrich present householders even additional. And if extra individuals are richer, there can be much less crime and fewer pressure on the federal government to supply.

Unintended Consequence: Hurting Asian Individuals

Each time the federal government decides to select winners and losers, there are typically unintended penalties. Here is one which I hadn’t considered.

One “unintended” consequence of getting larger credit score rating debtors to subsidize riskier debtors is the disproportionate destructive affect on Asian Individuals. I put the phrase unintended in quotes as a result of the federal government clearly sees all the info.

As an Asian American who grew up in Japan, Taiwan, Malaysia, and the Philippines for my first 13 years of life, I perceive how Asians view debt: not good. In consequence, Asian Individuals have a tendency to avoid wasting extra aggressively and pay for extra issues with money.

Due to this fact, it was no shock after I realized Asian Individuals have a median credit score rating of 745. Beneath is the typical FICO rating by race in keeping with the U.S. Federal Reserve information. Each race will get not less than a “Good” trophy.

Mortgage Utility Rejection Price By Race

Asking safer debtors to subsidize riskier debtors who’ve largely gotten ignored of the housing growth is one factor. Enabling extra Individuals to personal their major residence is nice for the nation, if debtors purchase inside their means.

However what in case you requested a gaggle of people that had been experiencing larger mortgage rejection charges than the baseline White borrower to additionally subsidize this riskier group? That would appear unfair.

Based on a 2021 research by the City Institute, Asian Individuals have a decrease homeownership charge (60%) than White Individuals (72%), regardless of having the next median revenue.

One purpose for this disparity, the research discovered, is that Asian Individuals have larger mortgage denial charges than White Individuals.

“We discovered that the denial charge for Asian mortgage candidates is 8.7%, in contrast with 6.7% for White mortgage candidates,” the authors of the research wrote. The authors studied the House Mortgage Disclosure Act (HMDA) information.

“Asian candidates are denied extra continuously than White candidates in any respect revenue ranges,” the research reviews.

“In 2019, median revenue was $107,000 for Asian candidates and $82,000 for white candidates. For Asian candidates with annual incomes beneath $50,000, 16.3% had been denied a mortgage, in contrast with 11.3% of White candidates in that revenue bracket.”

Why Are Asians Getting Rejected At A Larger Price Than Baseline?

No person is aware of the precise purpose why Asians are rejected at the next charge for mortgages as a result of the research additionally did analysis on rejection charges in large cities with giant Asian populations.

The explanation could possibly be so simple as extra first-generation Asian American candidates shouldn’t have the mandatory documentation to get via the mortgage utility gauntlet. I have been rejected earlier than as a result of I didn’t have not less than two years of ample freelance revenue after I left my day job in 2012.

At all times refinance your mortgage earlier than leaving your W2 day job please. When you not have a day job, you might be lifeless to lenders.

In a special research, in keeping with the House Mortgage Disclosure Act information, 20% of Black and 15% of Hispanic mortgage candidates had been denied mortgages, in contrast with about 11% of White and 10% of Asian candidates. So maybe the rejection charge is not so extreme for Asians in spite of everything.

Resolution For Asian Individuals And All Folks With Excessive Credit score Scores

In the event you do not personal a house but, then your solely plan of action is to grasp what’s taking place and negotiate together with your lender, actual property agent, and vendor. Who is aware of. You would possibly find yourself negotiating so successfully that you find yourself saving much more cash. Too many individuals are too afraid to barter on the subject of shopping for a home.

Debtors with excessive credit score scores nonetheless get the bottom mortgage charges and pay the bottom charges. Such debtors will merely have a barely much less whole lot than earlier than. Due to this fact, I would not attempt to recreation the system by purposefully tanking your credit score rating earlier than making use of for a mortgage.

In case you are an Asian American seeking to purchase a house, you might have to get not less than a 760 credit score rating, if not a 800+ credit score rating to have the identical likelihood of getting an identical mortgage as different races. I have never seen wherever that individuals with 800+ credit score scores must pay extra charges, solely these within the 740-799 vary.

Hold your debt-to-income ratio as little as attainable (30% or much less). That is a very powerful ratio when attempting to get a mortgage or refinance one. For extra, I wrote an in depth submit about learn how to cut back mortgage charges and get the perfect charge attainable.

In the event you really feel you might be being handled unfairly, converse up! This fashion, you will improve your probabilities of getting a aggressive mortgage charge.

Making an attempt More durable Is The Manner

Personally, I welcome the problem to earn extra, improve my credit score rating, pay down extra debt, and work tougher to care for my household. I’ll train these classes to my kids as properly. Making an attempt tougher and being financially accountable tends to repay.

On the finish of the day, having the next credit score rating and being in higher monetary form makes life simpler. If different people who find themselves struggling are getting a break, then good for them. The quantity of home-owner’s fairness householders have amassed since 1990 has been monumental.

Actual property makes up about 50% of my passive revenue. And passive revenue is what allows my spouse and I to dwell extra freely. I need all people to expertise the sort of freedom as quickly as attainable, therefore why I write on Monetary Samurai.

Since 1999, I’ve additionally been paying a major quantity of taxes every year to assist subsidize the ~50% of working Individuals who don’t pay any federal revenue taxes. Therefore, paying one other a number of thousand {dollars} in larger mortgage charges, if I determine to purchase one other home, will not be that large a deal.

After considering issues via, it appears like an honor to assist others additionally obtain the American dream. I used to be in a position to come to America in 1991 for highschool and construct my fortune. I hope many extra individuals get to do the identical as properly.

Reader Questions And Recommendations

What are your ideas on the Federal Housing Finance Company charging larger charges for these with larger credit score scores? What are the implications of this new coverage to the housing market? Are you for or towards probably homebuyers with decrease credit score scores attending to pay decrease charges?

Store round on-line for a greater mortgage charge with Credible. They supply customized prequalified charges for mortgage refinance in a single place so lenders can compete for what you are promoting. As mortgage charges decline, store round and take benefit.

To spend money on actual property extra strategically, take a look at Fundrise, my favourite personal funding platform. It presents a number of funds for various funding aims akin to revenue, progress, and stability. Fundrise primarily focuses on residential actual property within the Sunbelt, the place valuations are cheaper and internet rental yields are larger.

Subscribe To Monetary Samurai

Be a part of 60,000+ others and join the free Monetary Samurai publication and posts by way of e-mail. Monetary Samurai is without doubt one of the largest independently-owned private finance websites that began in 2009.

Disclosures: Requesting prequalified charges on Credible is free and would not have an effect on your credit score rating. Nevertheless, making use of for or closing a mortgage will contain a tough credit score pull that impacts your credit score rating and shutting a mortgage will end in prices to you. NMLS ID# 1681276, Handle: 320 Blackwell St. Ste 200, Durham, NC, 27701. We might obtain compensation from Credible in case you click on on a hyperlink/buy a product. Any opinions, analyses, critiques or suggestions expressed listed here are these of the creator’s alone, and haven’t been reviewed, authorised or in any other case endorsed by Credible.